This would have been true five years ago; not so today. Years ago Hermes

only had about 400 craftsmen and was opening new stores at a fairly

fast pace so supply did not begin to equal demand. Today Hermes has more

than 3,000 craftsmen and the Birkin has been around since 1984...so

demand is beginning to slow - and supply is exceeding demand. The

article (and ones like it) are quick to point out that an Hermes Birkin

sold last year at auction for $223K - but they don't mention

that that bag cost more at Hermes than $223K (so it defeats their

premise). And why do all of these stories perpetuate the MYTH of the

waiting list? There is NO waiting list. Even the CEO of Hermes, Robert

Chavez, has stated that there is no waiting list. My book debunks the

waiting list. And finally, your block of gold, your Exxon stock

certificate, will not lose their value if you get a drop of wine on

them....

Subscribe to:

Post Comments (Atom)

Blog Archive

-

▼

2016

(30)

-

▼

January

(6)

- Most Sought After (and highly collectible) Hermes ...

- The (luxe) Snooze-Fest Continues at Hermes Men's R...

- Apple Watch Hermès collection to be available onli...

- What’s the better investment: The S&P 500, gold, o...

- VERY Rare Hermes Bags at Artcurial Vintage Hermes ...

- Use This Simple Trick to Finally Own a Precious Bi...

-

▼

January

(6)

Links we Like:

REVIEWS

NBC-TV/Today Show

Summer Reading Round-Up

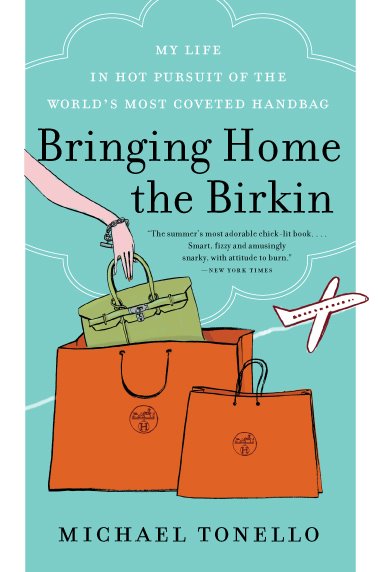

Bringing Home the Birkin

top 10 summer reads!

WATCH THE VIDEO:

http://www.msnbc.msn.com/id/21134540/vp/24775399#24775399

----------------------------------

NEW YORK TIMES

SUNDAY BOOK REVIEW

May 18, 2008

Bag Man

By CHRISTINE MUHLKE

http://www.nytimes.com/2008/05/18/books/review/Muhlke-t.html?_r=2&scp=1&sq=michael%20tonello&st=cse&oref=slogin&oref=slogin

Summer Reading Round-Up

Bringing Home the Birkin

top 10 summer reads!

WATCH THE VIDEO:

http://www.msnbc.msn.com/id/21134540/vp/24775399#24775399

----------------------------------

NEW YORK TIMES

SUNDAY BOOK REVIEW

May 18, 2008

Bag Man

By CHRISTINE MUHLKE

http://www.nytimes.com/2008/05/18/books/review/Muhlke-t.html?_r=2&scp=1&sq=michael%20tonello&st=cse&oref=slogin&oref=slogin

ONE STOP MEDIA / PRESS SHOP:

CBS / THE EARLY SHOW

http://www.cbsnews.com/video/watch/?id=4044433n

-------------------------------------------

NEW ENGLAND CABLE NEWS

http://www.necn.com/Boston/Arts-Entertainment/Hes-got-the-book-on-Birkin-bags/1209994267.html

-----------------------------------------

BOSTON GLOBE

http://www.boston.com/lifestyle/fashion/articles/2008/04/17/bag_man/

-----------------------------------------

PUBLISHERS WEEKLY

http://www.publishersweekly.com/article/CA6547849.html?q=%22michael+tonello%22

-----------------------------------------

USA TODAY

http://www.usatoday.com/life/lifestyle/fashion/2008-04-21-birkin-side_N.htm

--------------------------------------

http://www.cbsnews.com/video/watch/?id=4044433n

-------------------------------------------

NEW ENGLAND CABLE NEWS

http://www.necn.com/Boston/Arts-Entertainment/Hes-got-the-book-on-Birkin-bags/1209994267.html

-----------------------------------------

BOSTON GLOBE

http://www.boston.com/lifestyle/fashion/articles/2008/04/17/bag_man/

-----------------------------------------

PUBLISHERS WEEKLY

http://www.publishersweekly.com/article/CA6547849.html?q=%22michael+tonello%22

-----------------------------------------

USA TODAY

http://www.usatoday.com/life/lifestyle/fashion/2008-04-21-birkin-side_N.htm

--------------------------------------

No comments:

Post a Comment