Sales of high-end vintage attire and accessories are soaring—both in volume and price—and a handful of small businesses are taking advantage of market forces that are making what was old new again.

Veteran retailer Seth Weisser is in the middle of construction for his largest, most ambitious store to date: a 3,800 square-foot flagship just off Rodeo Drive in Beverly Hills, Calif. It will sell designer clothes, accessories, and jewelry; he plans special stores-within-a-store for Chanel and Hermès. “It will be extremely elegant, with high-end marble, brass fittings, and turn of the century Cartier showcases,” Weisser explains by phone from his office in New York, “This is going to be the ultimate luxury shopping experience.”There’s one crucial difference between Weisser’s newest boutique and those nearby, such as Louis Vuitton or Valentino: It will sell used clothing.

This will be the fifth outpost of his chain, What Goes Around Comes Around (WGACA), where absolutely everything for sale is second-hand or rather, “luxury vintage.” A recent boom in enthusiasm for vintage fashion has led to a rapid expansion for stores such as WGACA and growing profits, even when global fashion brands are faltering. In fact, its merchandise assortment is even more exclusive and thrilling to shoppers than many offered by neighboring stores. That Chanel selection—“We have the largest collection of vintage Chanel in the whole world,” Weisser claims—will include dozens of noteworthy bags and clothes from Karl Lagerfeld’s stint as head designer, as well as sought-after, discontinued pieces from its costume jewelry range.

As for the Hermès "concession," the centerpiece when it opens will be a Himalayan crocodile Birkin; a similar model sold for $185,000 at auction two years ago. You simply can’t walk into an Hermès store anywhere in the world and expect to be able to walk out with one of these, now matter how much you are willing to pay.

Vintage Is Booming

WGACA isn’t the only superior second-hand operation in the area: Indeed, Ben Hemminger’s Fashionphile has been selling top tier, gently used designer purses by Dior and Louis Vuitton from a jewel box-sized showroom in Beverly Hills since 2008. It’s tucked into an alleyway at the end of the same block as WGACA, less than 500 feet from an enormous branch of Barneys. “Actually, our showroom is right next to Louis Vuitton—our garbage can is the same as theirs,” Hemminger laughs, speaking by phone from the firm’s warehouse headquarters in Carlsbad, Calif..Both firms are booming: Weisser’s plush new site is 25 percent larger than its previous location in a busy block of La Brea, while Fashionphile logged $3 million in sales in February 2016, its strongest month ever, and business grew 50 percent to 60 percent year over year in 2015. They are prime examples of the new retail sector of luxury vintage, in which barely worn bags or designer dresses are sold at discount to women who might have shopped straight from the runway. They occupy sites adjacent to full-price rivals; sometimes, they even supply them. Weisser has contracts with such department stores as Lane Crawford in Hong Kong and Barneys in Japan to supply authentic, top-tier vintage for their sales floors.

Online Competition Is Growing

Online counterparts are jostling for the same business: Both TheRealReal and MaterialWorld operate similarly, trading on the newfound cachet for used clothes. The booming industry of prime vintage has been buttressed by the emergence of handbag-centric auctions such as those at ArtCurial in Paris or Fine Art Auctions in Miami. Christie’s was so keen to enter the luxury vintage business that in 2014 it poached the wunderkind head of Heritage Auctions’ bag-selling department, a twentysomething Matt Rubinger. Heritage perceived the defection as such a blow that it sued Christie's for $60 million.It’s still startling, though, to see a second-hand store—even one with such blue chip, red carpet credentials (Rihanna’s a regular) as WGACA—snap up prime retail space in Beverly Hills. Stylist Lauren Goodman suggests that this won’t be the last vintage tenant roped in by Rodeo Drive. She points out that much like fine wine, top-tier vintage clothes and accessories often appreciate in value. “You could buy a vintage Versace dress from the 1990s, wear it five times and resell it, and it’s probably gone up a little bit in value. I mean, everyone’s obsessed with the '90s right now,” Goodman says by phone from her home in San Francisco. (Remember the headline-making, albeit exaggerated claim that a Birkin bag by Hermès was a better investment than gold?)

New Stuff Is More Expensive Now, Too

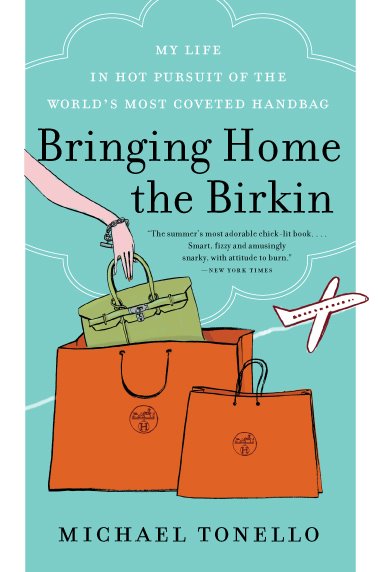

Goodman adds that the lure of vintage is also driven by the rising prices of new merchandise. Designer labels have deliberately hiked prices of core items over the past decade or so; the cost of Chanel’s bags, for example, rises an average 15 percent annually. “It makes vintage feel better value than ever, and it’s already survived the test of time.”Michael Tonello, who wrote the memoir Bringing Home the Birkin about his time as an Hermès reseller, agrees. “Ten years ago, a nice designer shirt was a couple hundred bucks,” he says by phone from his home in Barcelona. “Now, you look in a store window and every price has a comma in it—$1,000 or more.”

Other cultural and economic shifts are helping to bring WGACA and Fashionphile to the fore. Instagramming from the front row of a show might earn editors a few extra followers, but it softens the excitement that once surrounded the delivery of new clothes to a retailer, notes Goodman. “By the time someone wears a look from the runway out to a party now, the clothes already feel like last season. But if it’s vintage, it will exist outside of this cycle and won't have been liked 5,000 or 25,000 times on Instagram already. It’s special, unique, and it’s yours. You are making a bold, personal style decision.” This same impetus lay behind Burberry’s decision to create runways with instant buying options, starting in September.

Rihanna wearing WGACA on the Ellen DeGeneres Show on Feb, 4, 2016.

The Threat of Fraud

It might seem that the rise of luxury vintage is unstoppable, but a danger looms that could derail the entire industry: fakes. The resale market is lucrative and generally un-policed—charges around selling fakes are usually pleaded down to disorderly conduct, resulting in minor fines and no jail time—so it’s ripe for unscrupulous exploitation. The situation is made trickier by the emergence of a new class of counterfeits known as superfakes, essentially production overruns stolen from the factory and indistinguishable from authorized merchandise.It’s a threat that WGACA’s Weisser takes seriously. “We handle more of this product than anyone’s ever seen, so we get a very good comfort level on how to spot a fake. Our senior buyers are like scientists, and they will get down to counting stitches or even using techniques we’d prefer not to disclose.”

No comments:

Post a Comment