That’s why it sells so well.

Hermès inaugurated its CityCenterDC boutique with a grand, eccentric

flourish befitting a nearly 180-year-old French luxury firm that was

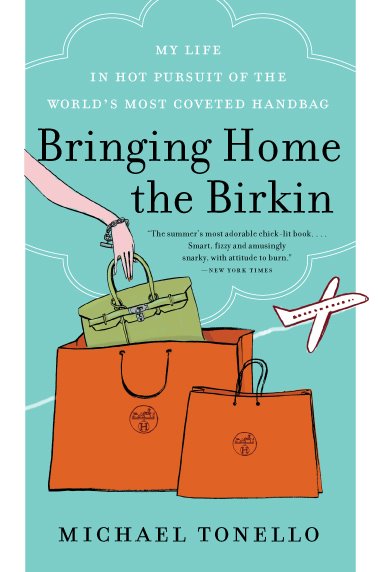

born as a harness-maker and grew into the purveyor of $10,000 Birkin

handbags. At a seated dinner in the stately surroundings of the Andrew

W. Mellon Auditorium, 120 guests began their meal with a foie gras feuilleté

and ended it with a white chocolate “flower pot” filled with

raspberries and mousse — a dessert so finely executed it could have been

a porcelain figurine.

Though the fine china upon which the

pea-crusted lamb loin was artfully arranged came directly from the

company’s stock, the dinner otherwise did very little to showcase the

actual stuff of Hermès. But in the digital millennium, luxury is defined

less by products than by experiences.

And so the company recently presented an evening of culinary theater

choreographed and costumed by Belgian artist Charles Kaisin (who

recently dazzled Hong Kong with a 35-foot golden goat constructed from

13,500 origami horses for Chinese New Year). Two sopranos trilled the

“Flower Duet,” and 60 waiters imported from New York — one for every two

guests, as if catering to a royal court — marched out in synchronized

precision to deliver the meal. They changed costume with each course:

silver origami masks, golden welding suits and, finally, white cumulus

headdresses lit from within.

Hermès is the latest high-end brand to open at CityCenterDC, the

gleaming mixed-used development newly built downtown. It joins Burberry,

Loro Piana, Canali, Hugo Boss, Salvatore Ferragamo, Paul Stuart and

Alexis Bittar, among others. This summer, Louis Vuitton will open; Dior

is coming in the fall. And in June, Carolina Herrera will throw open the

doors of a CH boutique — not quite as high-end, but perfumed by its

association with her flagship line and the glamour of a Vogue-sponsored

cocktail party.

Of all the brands, however, Hermès is arguably

the most rarefied. It is a shop where a business-card case — two small

rectangles of leather stitched together — costs $335. And the

suitcase-size Birkin and Kelly bags stashed not so discreetly under the

tables during the gala dinner each cost as much as a car.

The 6,000-square-foot Hermès shop, on Palmer Alley NW, replaces the

company’s Tysons Corner store. While this new space might be light and

airy, it is not a joltingly modern place with sales clerks toting mini

iPads in side holsters. Immediately upon crossing the boutique’s

threshold, there is a mosaic insignia embedded in the floor based on one

found in the mother store on the Rue du Faubourg Saint-Honoré in Paris —

a reminder of Hermès history and tradition.

The new Hermès store at CityCenterDC is one of seven new projects in the United States for a company thriving on a new demand for luxury goods. (Tony Powell)

The mosaic drives home the point that

Hermès traffics in slow fashion in an impatient, buy-it-off-the-runway,

want-it-now culture. Babies are conceived and born in less time than it

takes for a dedicated customer to acquire a Birkin handbag, which was

introduced in 1984.

In many ways, Hermès violates all the rules

of the modern retail environment, which is to make shopping as

effortless as possible — including buying a $10,000 handbag while

lounging at home in pajamas.

Yet shoppers want what Hermès is

selling even if they have to go out of their way to get it. The company

reported that its first-quarter revenue was up by 19 percent over last

year, to $1.2 billion. That growth was fueled by Asia and Europe, as

well as the United States — the No. 1 luxury market in the world. After

years of luxury firms chasing consumers in China, Russia and South

America, the United States is once again devouring high-priced clothes

and accessories. Hermès has seven projects in the works in the country.

Six, including Washington’s, are expansions in markets where the brand

already had a footprint; the seventh is a dedicated perfumery in New

York.

Hermès is one of the fastest-growing luxury companies in

the world, according to a 2014 report by Deloitte Touche Tohmatsu

Limited, with a Q rating — a measure of a brand’s resonance and value

among consumers — that places it third among luxury brands. That’s ahead

of Prada, Ralph Lauren and Burberry.

Hermès is so certain of its own mystique that since 2011 it has sold a

monthly mystery box to customers starting at about $250, which includes

a unisex trinket crafted from workroom scraps of leather, silk or the

like. “They’re making money out of their waste,” marvels brand

consultant Amy Shea, who has not worked with the company.

***

Hermès

is a contrarian company. It has no Twitter followers because it is not

on Twitter. The social media site is about personalities and

celebrities, and Hermès is not.

Hermès maintains a Web site that

resembles a charming old sketchbook sweetly animated. It is a pretty

site, but a frustrating one. There are no high-definition photos

sweeping, spinning or rocketing across the screen. The bags most closely

identified with the brand — the Birkin and the Kelly — aren’t even

represented. Ready-to-wear isn’t displayed on models, but on drawings of

models. There is no technology to give a shopper a sense of how the

garment might move. At a luxury conference this year, chief executive

Axel Dumas, a sixth-generation descendant of founder Thierry Hermès,

joked that the company wants its things to be difficult to find — even on the Web site.

“Hermès

is in a special place all to itself. They have coveted their rarity and

they had to do it with all the temptations that a brand faces,” Shea

says. “They didn’t know which way things were going to go [in the luxury

market], but they knew who they were.”

The brand has no public

face making the rounds at cocktail parties. It does not hire celebrities

to be brand ambassadors. It does not make a splashy showing on red

carpets — although it has been represented by Angelina Jolie, Keira

Knightley and Carla Bruni-Sarkozy. The name most people might associate

with the brand is Oprah Winfrey. Not because she is a devoted customer

but because the Paris store once denied her after-hours shopping

privileges. (The company later expressed regret.)

Last summer, Hermès announced the arrival of a new creative director:

Nadège Vanhee-Cybulski. Her hiring was news in the fashion industry,

but it meant little to the brand’s customers. For them, it’s the Hermès

name that counts, not that of the person sketching the cashmere

overcoats, which look an awful lot like the overcoats from previous

years. The ready-to-wear “is timeless,” says Robert Chavez, the

company’s U.S president. But that doesn’t give a fashion designer much

room to experiment.

Vanhee-Cybulski arrived at Hermès with an

impressive résumé, notable for its legacy of discretion. She has worked

for some of the most restrained brands in the industry — the Row, Maison

Margiela, Céline. She presented her first collection on the runway in March. It will arrive in stores for the fall season.

“I

think she brings her own touch and imprint,” Chavez says. “It’s

refined, in a modern way.” It is profoundly subtle and it looks very,

very expensive, which is the definition of the Hermès brand.

***

Hermès

fashion moves stealthily, changing millimeter by millimeter, but the

company has excelled in the speed-of-light digital realm by keeping to

its own quirky path, says Isabelle Harvie-Watt of the fashion and luxury

consultancy Havas LuxHub.

In a recent speech, Harvie-Watt

criticized luxury firms for failing to be more active in the digital

realm. For most, their early response was a defensive crouch. And yet,

she says, “I think Hermès is one of those that have merged technology

quite well with their brand.” The Web site,

in all of its obstinate inefficiency, speaks to the brand’s identity,

she says, “even though it might not be the easiest thing to navigate.”

And while Hermès skips Twitter, it does use Instagram and Facebook

to connect with customers. The Web site, which launched in 2002, has

been the fastest-growing “boutique” within the company, Chavez says. “We

have a presence in 14 states, but we ship to all 50 states. Early on,

it was the classics, but now we sell bikes, place settings . . . ”

Like most of the retailers at CityCenterDC, Hermès defines itself as a

luxury brand. But the term luxury has been bandied about so much that

its meaning has turned murky. Longchamp, another shop at CityCenterDC,

also considers itself a luxury brand, one with a legacy and point of

view. The family-owned business recently celebrated the 20th anniversary

of its signature handbag, Le Pliage. A customer can buy a nylon version

for less than $200 from a host of outlets.

Shea argues that

“luxury” has been redefined — in Hermès’ favor — and it has nothing to

do with price. “Expensive doesn’t equal luxury,” Shea says. “Luxury

equals rarity.”

“The millennial group continues to covet” the Birkin, Shea says. Why?

They are global citizens who have “been raised with incredible access to

all thing via technology. It’s changed the consumption model in a way

we’re still trying to understand.” The same motivation that has people

choosing craft beers — small, independently owned, artisanal — attracts

them to a brand such as Hermès.

Chavez says the craftspeople who construct the company’s handbags are

core to his definition of luxury. But he notes that time is the truest

indulgence. “People are always willing to wait for quality,” Chavez

says. “They know that it takes time. It takes more than 20 hours to make

a Birkin.”

Luxury fashion, Harvie-Watt notes, has yet to produce

an equivalent of Uber — a company so transformative that it’s hard to

remember a time before it existed. “For these kinds of brands, the

question is how to leverage technology to give customers better

service?”

“Maybe someday you can order [Birkins] online,” Harvie-Watt says, “but you’ll still have to wait for them.”

-by Robin Givhan; The Washington Post

No comments:

Post a Comment