The world

of fashion may appear to some as a fluffy, vacuous domain populated by

models and fashionistas draped in the latest bizarre creations, but it

is a valuable sector – demonstrated this week by the £2.3billion

mega-merger of luxury fashion websites Net-a-Porter and Italian giant

Yoox.

Combined

sales of the two websites is almost £1billion, and the desire to

purchase the latest 1970s-inspired designer fringe handbag or bohemian

floral cape has fuelled these businesses’ growth.

Dedicated

followers of fashion who often spend the average monthly salary on

Net-a-Porter items justify their extravagance by calling it an

‘investment’ piece – as do fashion addicts, though they sometimes

comfort themselves with the thought that what they are buying is a

‘classic’.

But rather than buying a handbag should a savvy shopper instead invest in the retailers themselves?

Shares

in the major luxury brands have soared over the past half decade, and

even British upstart Mulberry, whose shares crashed in 2012, is still a

top performer if you take a five-year view. Even with Italian brand

Prada lacklustre this month – because of the crackdown on lavish

spending in China – investors have not been put off the sector.

Rahul

Sharma, consumer analyst at Neev Capital, said: ‘In the past five years

luxury stocks have done very well. Some are up 15 per cent year on year.

Many have tripled in value, though the average handbag has not lasted

as well.’

But

with clothing re-sale websites springing up around the world, which are

doing a roaring trade, is it really better to buy shares in a fashion

retailer or its latest ‘it’ bag?

Looking

at the returns on some items on websites including Tags On, Vestiaire

Collective, Asos-owned Covetique and flash sales website Secretsales.com

reveals that well-kept items such as handbags can sometimes be sold for

near the purchase price. Some will use the product for a few months

before selling it again.

But there are no guaranteed returns from a luxury resale website – it depends on the brand and the product.

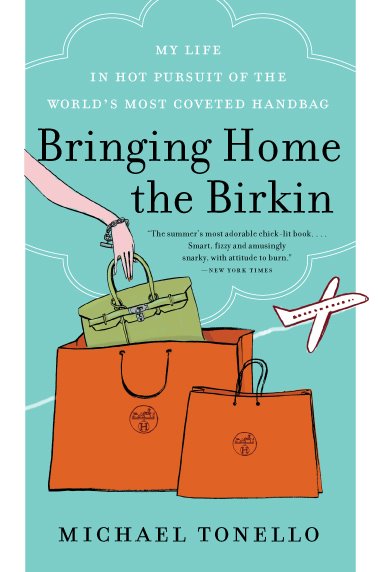

Nicola

McClafferty, chief executive and co-founder of Covetique, says French

brand Hermès has the ‘most key investment pieces’. Some sell at auction

for thousands and a Hermès Himalayan Nilo Crocodile Birkin bag with 18c

white-gold accessories sold for $185,000 (£125,000) last month. She

adds: ‘High resell values in Hermès is driven not just by the highly

coveted nature of the brand but also by the fact it is one of the few

brands that consistently raises prices annually.’

Requiring

a little less outlay could be a bag from Mulberry. The British brand

tried to reinvent itself in 2012 and hired Bruno Guillon from Hermès.

But after multiple profit warnings, Guillon left last year. Last month

it appointed foreign fashion veteran Thierry Andretta as chief executive

and hired a new creative director – former Céline accessories design

director Johnny Coca – who starts this summer.

Sharma

says: ‘I am not overly keen on Mulberry shares but they are doing the

right thing now.’ He adds that Hermès is an exception, saying: ‘Many

companies have introduced so many different styles that very few of the

older items – except perhaps Hermès – have held their value. As

investments they don’t compare with investing in actual shares.’

Looking

at the stats, Sharma is right. The return on a Burberry trench coat or

Louis Vuitton handbag is paltry compared with the rise in share price:

LVMH shares have more than doubled and Burberry nearly trebled since the

start of 2010. If, five years ago, you’d spent the price of a Louis

Vuitton Alma bag on shares, you’d now be able to buy the handbag with

the profit.

Shoes

might not represent such a good return. Jimmy Choo listed in October at

140p a share: its shoes resell for about 45 per cent but shares are up

more than 20 per cent.

But

have luxury stocks peaked? Sharma thinks not: ‘The sector is still in

good shape and I believe it is still a good investment.’

Laura

Levy, luxury research analyst at Barclays, adds: ‘We see luxury as an

attractive sector to invest in driven by the emerging market consumer.’

For

the shopper who is both fashion conscious and investment savvy, the

solution might be to buy shares and shop – Mulberry offers a 20pc

discount on up to £5,000 of purchases to investors who have a minimum of

250 shares. So, splash out just north of £2,000 on shares and you can

snap up a £995 Bayswater, a £1,200 Cara Delevingne rucksack, a £595

Tessie tote and a £1,600 Willow Tote each year – funds permitting – and

save almost £1,000.

http://www.dailymail.co.uk/money/markets/article-3022107/Bag-portfolio-better-buy-classic-fashion-item-shares-retailer.html?

No comments:

Post a Comment